Post-independence, the defence industry followed the Nehruvian philosophy on the lines of the Russian model, which treated the defence sector as a strategic sector totally under the government with no interference from the private sector.

The first ordnance factory came up in Ishapur in the year 1801 under the aegis of the British East India Company producing assault rifles and its kind. It was in the 1955-1965 period that most of the ordnance factories came up.

Most of these factories came up in areas which got dictated by political concerns rather than based on strategic or technological considerations. Even today, we are making the same mistakes by locating defence corridors in constituencies that have been conceived on political lines.

OFB: The Defence Manufacturing Hub

The OFB was largely a manufacturing hub for military hardware, indigenisation, transfer of technology and maintenance of WWR Capacity. It was a blend of old and state of art technology. For example, the new ordnance factories which came up in Nalanda (ammunition and explosives) and Korwa (weapons and equipment) are fairly modernised. Today, we have 41 ordnance factories and 32 other related establishments which cater for proofing, research and development etc.

The OFB functions on indents placed by the armed forces for its war wastage and training requirements. Indents for ammunition are based on a five-year roll-on plan based on our requirements for 40 days intense requirement which presently has been capped to 20 days intense requirement.

The vehicle spares, armoured vehicles, clothing etc are based on yearly indents based on target fixation meeting between OFB and the users held every year.

As per the latest reports on the Standing Committee for Defence 2020, the present OFB capacity is limited to Rs 17,000 crore (including GST) per year worth of orders. The present value of orders range between Rs 900 crore to Rs 1200 crore.

The OFB spent a meagre Rs 5,600 crore in the last five years on modernisation related to new machinery, renewals and works. Its expenditure on research and development has been again a pittance i.e., 0.5 percent of its overall budget as also the value of exports averaging just Rs 200 crore per year.

The major achievements of the OFB over the years have been the manufacture of the artillery 155mm Dhanush gun. An order of 114 guns was placed by the Indian Army in April 2019 and so far, only 12 guns have been supplied.

Another important milestone has been the up-gunning of the 130mm medium gun to 155mm. The Indian Army has placed an indent for 300 guns.

The OFB have also developed a prototype for a new air defence gun. It has recently manufactured the electronic fuses for 155mm guns which were deficient over the years.

The area where not much headway has been made is in developing ECC clothing for high altitude i.e. in excess of 18,000 ft and temperatures of minus 40 degrees Celsius.

The Existing Defence Industrial Base

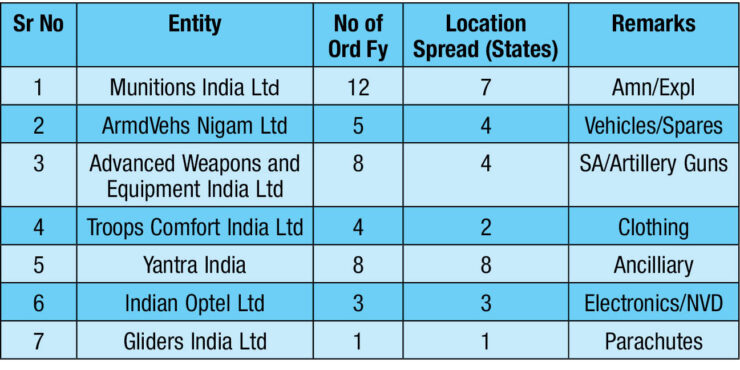

It may be worthwhile to carry out an analysis of the existing industrial base of OFB to bring forth certain important deductions which would contribute immensely to set the road map for corporatisation of the existing entities which have been put into seven segments namely as under:

Why Corporatisation

The need to bring in a change of mind set was felt as early as in the 1990s wherein there were complaints relating to poor quality, delays in supplies, lack of technology absorption as well as accidents taking place on a regular basis.

We had the TKA Nair Committee in 2000, Vijay Kelkar Committee in 2006 and Raman Puri Committee in 2016.

However, it was the present government under PM Modi which broke the shackles and announced the implementation for corporatisation of OFB. Hence w.e.f. from October 1, 2021, OFB ceases to exist.

How is Corporate Different

The corporatisation is likely to bring in a different organisation culture which would be based on a greater accountability and responsibility. We would now be open to competition, have a mechanism for price delivery, an incentive for those who perform and be subject to contract negotiation and fulfilment. It’s a welcome step towards a forward thinking and KPMG has been co-opted as a consulting firm to see through the implementation of the process.

Case Study to Understand Important Issues Involved

Taking an assumption that all SOPs, procedures, policies etc have been put in place, let us understand through a case study the important issues which would require a focussed approach.

A case has been built up on “The Advanced Weapons and Equipment India Ltd”. This company has an existing turnover of Rs 1,500 crore and it produces carbines, medium calibre guns, rocket launchers, rifles, pistols, barrels, revolvers, LMG, MMG and so on.

Its work force strength is 17,000 and is located in eight divisions i.e. Jabalpur (gun carriage), Ishapur (rifles), Kanpur (field guns, small arms etc. There are three divisions in Kanpur, Cossipore (guns and shells), Dumdum (ordnance) and Korwa (assault rifles).

As is evident these eight divisions are located in four different states and hence supply chain management and command and control of processes will pose a serious challenge.

The ancillaries i.e raw materials and spares required will also need to be transported from only Jabalpur, Ishapur and Dumdum as no ancillary units are located at Kanpur, Cossipore and Korwa.

The Korwa ordnance factory is presently underutilised, there are issues relating to the design function, overheads, pricing, upgradation of machinery and a cyclic order mechanism which would ensure continuous flow of orders.

Strategic Insights into Corporatisation

It would be imperative to do an analysis on the strategic insights of corporatisation, taking each entity into consideration in order to set up a future road map.

Reduced Demand: It should be presumed after due interaction with the defence services that the overall demand pattern on ordnance factories would be around Rs 11,500 crore for the next five years. Therefore, it could be safely presumed that the capacities of some of the entities would remain under-utilised. This would largely be on account of the re-prioritisation of the defence budgets due to the state of our overall economy since almost 95 percent of the revenue of these entities are dependent on the government budget, as also a committed liability of 220 US billion dollars on imports.

Implications: This would impact the pricing mechanism and result in increase of prices as well as would affect the overall turnover.

Impact on Advanced Weapons and Equipment India

Survival Of Artillery Group: Would largely depend upon the capability to ramp up the production of the Dhanush medium gun to 48 guns per annum. There would be a requirement to develop private vendors on priority. Need to renegotiate “Sarang” up-gunning contract. This would provide a revenue of almost Rs 800 crore annually.

Survival of Small Arms Group: This would sustain itself as 5.56 INSAS would be getting replaced by Indo-Russian Rifles Pvt Ltd with AK-203 rifles. Will also optimise rifle factories at Ishapur and Korwa.

There would be a requirement to explore alternate markets like MHA, Assam Rifles, Police etc with demand for Excalibur rifles, sniper rifles, 5.56mm carbines, 7.62mm Trichy assault rifle and so on.

Two groups may struggle as they face the brunt of disruption of existing mutual synergies and supply chains, caused by splitting the organisation into seven groups.

Impact on Optel India Limited

This entity will be under a serious threat due to the disruption of the supply chain. Its old customer such as Armd Vehicles Nigam Ltd constitute almost over 90 percent on orders, would not go for a global tender. It would be difficult to import due to IP issues and would need time to explore alternate markets. Therefore, there would be a requirement of hand holding for almost three years as there are no alternate markets available.

Impact on Yantra India Ltd

The Yantra India Ltd is largely dependant on small arms/artillery/tank ammunition, its orders for mainly shell casing, cartridge cases, packing material etc largely meant for Munitions India Ltd. Over 90 percent of its earnings are inter-factory demands out of which 80 percent are from Munitions India Ltd.

There would be a need of a price preference clause of around 15 percent or hand holding for a period of three years. Further it doesn’t have factories located at Avadi, Ambernath, Medak and Jabalpur which would contribute to supply chain issues.

Impact on Troops Comfort India Ltd

Troop Comfort Group is likely to face degrowth due to incrementally reducing demand.

The government has already announced the phasing out of clothing to the tune of more than 200 items through procurement by a global tender. This would seriously impact the sustenance of this entity. A cut in about 25 percent manpower is envisaged as well as diversification into parachutes.

Three groups which have a comparatively firm starting block

Impact on Armed Vehicles Nigam Ltd

Its present turnover is Rs 2,500 crore. This is likely to increase by 6 percent in the next five years. It has its order book full from existing orders for ‘A’ vehicles for the next five years. There are also perspective orders for the stallion vehicles, LPTA, mine protection vehicles from the MHA which would contribute almost Rs 800 crore per annum.

Impact on Munitions India Group

Its present turnover is Rs 4,400 crore. It is likely to grow around 8 percent per annum for the next five years. It needs to diversify in other areas.

Impact on Gliders India Group

A yearly growth of about 8 percent s envisaged. It is in a monopoly sector and can aim for improvement in technology.

Summary

Contrary to the popular belief, corporatisation will lead to an increase in prices. In the past, OFB was functioning on a ‘No Profit No Loss’ basis supplying at ‘actual cost of production’, but with additional overheads.

Now they will operate under corporate pressures, where cost of maintaining working capital and R&D costs will have to be taken into consideration and added to the cost of production besides the fact that a reduced demand due to a reduced budget will create its own pressures in some cases.

The anticipated benefits of defence corporatisation can often be more than outweighed by unanticipated outcomes. Therefore there must be focus on economies of scale. Production of some ammunition items for example 14.5mmAPI/APIT, 130mm HE and 105mm HESH were at risk of being stopped as demands were erratic and therefore continued production of such items made it financially unviable for the new corporates.

In addition, if requirement of select ammunition is reduced to 20-25 percent of previous demand levels for a considerable time, then it will be difficult to suddenly enhance production.

A related point was the requirement of maintaining a “surge capacity”, which has been stated as one of the aims of corporatisation.

As a corporate entity with commercial accounting, cost of maintaining war reserve capacity is again financially unviable. If a surge capacity is to be maintained, there is a requirement of additional funds for infrastructure and wages for the surplus man power.

The Vehicles and Opto Electronics Groups as well as the Troops Comfort Group will face challenges related to demand, IP and contractual issues, since critical components were still imported and thus could not get clearances from OEMs, in spite of an existing demand for the end products.

It would be prudent to commence measures to find a solution here with foreign OEMs at an appropriate level, as this is bound to reduce exports by a considerable degree. Further, removal of offset obligations from G2G deals also reduced export opportunities and may be reinstated.

Keeping external factors aside, the need of the hour is an inculcation of self-belief, self-esteem and confidence and removing apprehensions amongst the work force of the ordnance factories.

Two issues need resolution by the government: One, status of the officers and workers after the initial period of two years for which the government has agreed to extend the existing terms and conditions of their employment.

Two, clarifying apprehensions about golden handshake or side stepping offers to other ministries/departments/government organisations.

Moreover, the existing surplus manpower is not capable of performing functions like finance, and marketing and will require personnel with experience from other PSUs/DPSUs.

The government is confronted with serious challenges which need to be taken up in the right earnest to be able to even get a wink towards “Atmanirbhayata”.

-The writer is a former MGAOC Central Command. He has served in various important assignments in the Indian Army in Jammu and Kashmir and the North-East. He covers defence issues on various national TV channels. His recent book, “Breaking the Chinese Myth”, has been a best-seller on Amazon. Views expressed are personal and do not necessarily reflect the views of Raksha Anirveda