The Indian Army is in the midst of a massive modernisation drive that will re-equip over a million troops with advanced personal arms. In parallel, the country’s paramilitary forces, comprising nearly a million soldiers, have unequivocally declared they would no longer accept shoddy INSAS rifles. Since a procurement exercise of this scale is no longer viable through imports, the key to equipping the forces is indigenisation.

The country’s long search for quality small arms – which includes rifles, carbines, sniper rifles and handguns – seems to have forked into the following directions:

Firstly, outright imports. In 2019 a tender competition narrowed down the participants to the US-based SIG Sauer’s SIG 716 rifle and the UAE arms firm Caracal’s CAR 816 carbine. The SIG 716 was selected after the company quoted the lowest price for India’s fast track procurement of 72,400 new assault rifles. Of the total order, the Navy gets 2,000, the Air Force 6,000 and the Army 64,400 rifles. In a separate bid for 94,000 carbines, the CAR 816 carbine got the green light after Caracal’s quote was found to be the lowest. Both the SIG 716 and the Caracal 816 are based on the American AR-15 rifle.

Secondly, the Indian Army has signed a contract with PLR Systems partner Israel Weapon Industries through the Fast Track Procurement route for 16,479 Negev 7.62x51mm light machine guns (LMGs). For the balance quantity of 40,949 LMGs, the Ministry of Defence issued a request for proposal (RFP) in October 2019 with the categorisation being Buy & Make (Indian). PLR Systems is one of the five companies which has responded to this RFP.

Thirdly, there is a government to government deal with Russia for the procurement of 750,000 Kalashnikov AK-203 assault rifles, with 40,000 to be directly imported. A brand new plant has been built at Korwa in Uttar Pradesh where the assault rifles are to be manufactured by a joint venture firm in India led by Ordnance Factory Board (OFB) under the Buy & Make (Indian) category. The AK-203 is a modern iteration of the legendary AK-47 assault rifle. These deals are the closest the Indian Army has come to equipping its infantry soldiers with new small arms in over a decade. However, they are not a permanent solution for two chief reasons.

One, imports are at best a short-term solution as these rifles will need replacement within a few years. Then it’ll be back to tendering and red tape and – depending on which government is in power – the inevitable corruption scandals.

Two, the Kalashnikov deal has hit a bottleneck. The Rs 4,300 crore project has been stalled for over a year, with the Russian partner and the OFB unable to present a reasonable pricing plan. This is nothing new in deals involving Russian manufacturers. In fact, it is a pattern that goes all the way back to the 2001 Gorshkov aircraft carrier deal where the cost quickly ballooned from US$700 million to US$3.2 billion. Don’t forget this is a marriage involving the Russia, which has an atrocious supply chain system, and an Indian public sector monopoly not known for its work ethics. If morning shows the day, it’ll be a long time before the Korwa plant produces a single Kalashnikov.

Private Push

Thankfully, there is another way out of the quagmire. This time the government has left the door open for a number of private manufacturers to start small arms production in India. In June 2018, the government revised the Arms Rules 2016, allowing private companies to set up manufacturing units in India and cater to export orders. As per the new rules, Indian companies will be granted a seven year licence after due vetting and will be allowed to set up units in special economic zones.

Also, under a new policy on ammunition, the Ministry of Defence is willing to provide long-term commitments and firm orders of multiple types of ammunition to private players, but at competitive prices. This allows private companies a crack at the over US$1 billion ammunition market which is currently dominated by foreign importers and the OFB.

Raksha Anirveda spoke to five of the new private companies which have quickly moved into the small arms and ammunition manufacturing segment. Here’s what they say.

Company:PLR Systems

Location: Bhind, Madhya Pradesh

PLR Systems is an Indian Joint Venture with Israel Weapon Industries (IWI) to manufacture the entire range of IWI weapons from MASADA pistol/Uzi Sub Machine Gun, TAVOR, NEGEV and Galil family of weapons in India. The PLR plant came up in Bhind, Madhya Pradesh in 2017 and since then PLR has supplied Made in India X95-Micro Tavor Carbines, Uzi SMG and Galil Sniper Rifles to Indian state police and CAPF making it India’s first private small arms manufacturer. PLR is participating in all GOI small arms tenders as an Indian Prime, notably the 40,949 balance quantity LMGs tender wherein India has recently signed the contract of 16,479 NEGEV LMG with its partner IWI. In IWI, PLR has found an ideal partner whose products were already in service and being used by the elite be it the Special Forces, PARA battalions, MARCOS, CRPF & BSF Special Units.

According to company Director Col Ajay Soni (Retd) the government’s decision to increase the FDI limit to 74 percent, procurement of upto 200 Crore only from Indian companies and the introduction of negative import list will go a long way in giving the Make in India campaign the much needed impetus. “Small Arms are an ideal starting point for achieving self sufficiency because there is a long outstanding demand for modern small arms for our troops and the technology is relatively easy to absorb”, he says.

Soni brings out that in response to Make in India, PLR identified a world class small arms product line, partnered with the OEM, brought and absorbed technology, and has started manufacturing full products in India. “It’s time for the Govt to walk the talk of VOCAL FOR LOCAL, as India for the first time in PLR has an entire range of best in class Made in India small arms products to choose from.” He is positive that in coming days more states, CAPF and Armed Forces will consider his products over any foreign OEMs.

Soni feels small arms manufacturing in India is a highly licensed and regulated domain, may be the most regulated of all defense products and rightly so. The government after issuance of license after strict diligence must facilitate the processes of multiple clearances through a single window concept. “The private sector still new to small arms manufacturing needs govt’s support in terms of access to local firing ranges, govt labs, interaction with end user for feedback on product under development, and faster import export clearances.”

Meanwhile, PLR Systems has set its sights further afield. “We are in talks with multiple nations for export of our products and have received encouraging response from some of them. The role of our High Commissions and Defense Attaché is pivotal in advocating Indian products in their respective countries and regions to shape India’s future sales.”

As a former Armyman, Col Soni says he cannot describe the feeling of pride seeing an Indian soldier holding a weapon manufactured at his plant. “We look forward to seeing more entrepreneurs participating in the Made in India campaign and the government rewarding their entrepreneur spirit.”

Company: SSS Defence

Location: Bangalore, Karnataka

SSS Defence is the defence and aerospace umbrella brand of Stumpp, Schuele and Somappa Springs Pvt Ltd which is a company with more than 70 years of manufacturing experience. SSS Defence focuses on manufacturing weapons and weapon systems; in particular small arms, ammunition, high-end optics and firearm accessories and tactical gear for military and law enforcement.

In business since 2017, SSS Defence has small arms, ammunition and military optics as platforms. Its products include the Saber, a .338 Lapua Magnum long range sniper weapon; the Viper, a 7.62X51 mm tactical sniper weapon; and the P-72 family of rifles. Soon to come are products for the international civilian and sport shooting market.

The company’s small arms platform is a 100 per cent Indian owned company and has no foreign joint ventures. “We do not foresee a partnership considering that a phenomenal effort has been invested in the development of intellectual property from our India R&D ops,” says CEO Vivek Krishnan.

The military optics platform too is 100 per cent Indian owned and holds its own design for products. The ammunition platform of SSS Defence holds a joint venture and strategic partnership with Companhia Brasileira de Cartuchos. This unique alliance will be the first to produce small and medium calibre ammunition within the private sector, and service both domestic and export demand. A world leader in ammunition for portable weapons and one of the main suppliers to NATO, CBC is a premier defence brand in the small calibre segment.

SSS Defence received the industrial license for manufacturing small arms via the Ministry of Home Affairs in 2018 and commenced planning for the small arms plant. The first phase of the small arms plant at Bangalore will be operational in November 2020. Construction of the ammunition plant will also commence soon and the plan is to be operational in July 2021. This unit will come up on over 60 acres of land in Anantapur, Bangalore, and will include manufacturing, ballistic labs and tactical range (for advanced training) infrastructure. This will be a first in the Indian private sector space.

According to Managing Director Satish Machani, all products that SSS Defence has introduced so far have been indigenously designed and developed. “A modern approach to development included the use of additive manufacturing, flow dynamics, simulation and a very advanced UX design philosophy,” he explains. “We applied anthropometric data to design for Indian physical forms. The use of materials is another area where we have invested significant time and resources. Our parent company’s core competence in industrial scale manufacturing with metal alloys allowed us access to high end metallurgy and processes. For the most part, we have used aerospace grade alloys in our construction and continue to work on lightweight alloys. Our bolt actions for the sniper are proprietary designs and do not build on any existing system like the Remington 700.”

The advantage of SSS Defence’s approach is the company can leapfrog certain elements of weapon construction where the West and Russia have traditionally been slow, owing to their persistence with older manufacturing processes. This allows the company to develop advanced technology within its labs – a new way of doing things in the Indian defence sector.

Krishnan believes that small arms manufacturers in India need to be given a chance. “The Make in India policy introduced in 2016 lit a fire in the hearts of many entrepreneurs,” he says. “The potential within India is immense, and the advantages of buying from an Indian manufacturer would be ten-fold.”

However, these are early days and there are several teething issues. Krishnan lists out the critical ones:

i) A large number of Indian manufacturers seek solace in transfer of technology. While there is some value in it, there is a tendency to believe that transfer of technology in itself is a silver bullet. In several cases, the Indian partner ends up like a Build to Print manufacturer or component supplier to the global OEM. A drawn-out battle ensues thereafter to ensure that indigenisation takes place instead of reliance on CKD/SKD options. The Indian government can ensure that Make II and IDDM (Indigenously Designed Developed and Manufactured) cases are given priority over indigenous manufacturing with just cosmetic transfer of technology.

ii) Ensure that the use of military and public sector infrastructure that relate to testing is made available to Indian manufacturers.

iii) Global tenders should be the last option and relied upon only when there are absolutely no Indian vendors capable of putting forward viable options. Recent steps like the restriction on issuance of global tenders for acquisitions less than Rs 200 crore will surely help.

iv) Every country has policies that encourage domestic industry and restrict competition. The champions for free market – the US and Europe – have regulations like ITAR and the Buy American Act to ensure domestic firearm and defence industries are protected. The government needs to take a few risks here and allow for some level of protection to the small arms and ammunition sectors.

iv) Every country has policies that encourage domestic industry and restrict competition. The champions for free market – the US and Europe – have regulations like ITAR and the Buy American Act to ensure domestic firearm and defence industries are protected. The government needs to take a few risks here and allow for some level of protection to the small arms and ammunition sectors.

v) Acquisition of foreign capital equipment via agents and authorised representatives of foreign OEMs should be given the lowest priority in government tenders/bids irrespective of the agency – MoD or MHA.

vi) The timeline for closure of bids and arbitrary cancellation of bids is a clear negative for risk taking in the private sector. If the military space has to grow, the government has to have specific project management teams for critical procurements that can work in tandem with industry for identifying and closing requirements in a time bound manner.

vii) Encouraging exports of defence equipment including small arms and ammunition is a great step that the present administration is pursuing. The strategic geopolitical value of being a defence powerhouse is now starting to take meaning. We need more aggressive steps in this direction.

viii) The policy should encourage a Special Forces Technology cell. We are very keen to apply some of our advanced tech so that bespoke products for our special forces can be developed. Firms like us would be keen to work on such weapons despite the smaller size of orders. For us, these are opportunities to showcase our commitment to the forces. Indeed, the US Special Operations Command (SOCOM) has programmes of this variety and many exciting products like the Next Gen Squad Weapon (NGSW) have evolved this way.

ix) Framing of GSQRs should be more in tune with practical reality.

Company: Hughes Precision

Location: Bangalore, Karnataka

Hughes Precision was incorporated in 2016 for the manufacture of defence equipment. The company is a part of the Deep Group, a Rs three billion diversified business conglomerate with interests in global automotive marketing, emerging technologies like data analytics and virtual retailing, IT solutions and services, micro electronics and electronic sub systems design and manufacturing, heritage artifacts, and more.

Sanjay Soni, Director, Hughes Precision, believes there is a huge potential in the Indian small arms and ammunition market. “The recent policy developments are very positive for the sector and will give a boost to the local defence industry,” he observes.

Sanjay Soni, Director, Hughes Precision, believes there is a huge potential in the Indian small arms and ammunition market. “The recent policy developments are very positive for the sector and will give a boost to the local defence industry,” he observes.

The company’s current manufacturing capacity is seven million rounds a year. The product range starts from 9x19mm and goes up to the 12.7x108mm cartridge which is used in anti-aircraft guns. It also manufactures different type of bullets such as FMJ, ball and armour piercing, and has received orders from the UAE, Russia and the Czech Republic.

In addition, Hughes Precision has bid for the Indian Army tender for 4.34 million rounds and has received enquiries from several other domestic and international customers as well. “We will be exporting a major part of our production and that is the reason for setting up the company as an Export Oriented Unit,” says Soni. “We are producing cartridges to NATO specifications and testing is carried out as per NATO standards. Therefore, we will be supplying cartridges of the highest international quality to the Indian armed and paramilitary forces.”

Hughes Precision has opted for using American technology which is already being used by other manufacturers in the US and in several other countries. The technology lends itself to manufacturing with a high degree of automation and precision. The setup and changeover time between production runs of different calibres is minimal thus enabling the company to meet demand for a range of calibres from the same machines.

Commenting on the Indian defence manufacturing sector, Soni feels one of the biggest obstacles is the complicated procurement procedure which is extremely difficult for MSMEs to navigate. Secondly, the DGQA doesn’t have updated specifications and continue to follow antiquated testing procedures for small arms and ammunition. “The procurement cycles are also very long and can take years,” he says. “How does a manufacturer sustain in the interim is a question most entrepreneurs looking to get into this field are faced with.”

Company: Kalyani Group

Location: Pune, Maharashtra

For more than 35 years, Kalyani Group has been a traditional supplier of components and subsystems to the Indian defence sector. Its product range are ammunition and shells, aluminum road wheels, track shoe assembly for tanks, Grad BM 21 rocket tubes, T-72 crankshafts, front axle beams, steering knuckles, transmission parts, etc. However, all these supplies were restricted to the component and subsystem levels. Kalyani Group is now targeting the system level segment.

The company believes the recently released Draft DPP 2020 and the Public Procurement Policy favourably support production by Indian companies. Going ahead most programmes will require indigenous products. “These policy developments will provide the much needed impetus to the small arms business in India.” says Rajinder S. Bhatia, President, Defence and Aerospace.

The Group is currently in the process of setting-up a dedicated state-of-the-art facility for small arms including a hammer forging facility required to manufacture small arms barrels. According to the company, “No private industry in India has the capability to manufacture small arms barrels. In this process we are absorbing technological knowhow from various global partners and skill sets to develop and produce these small arms,” says Bhatia.

Currently, Kalyani Group is manufacturing the complete 5.5x30mm calibre weapon for DRDO with their existing capabilities and dedicated supply chain partner. It has successfully completed the initial trials with Getting-First-Time-Right manufacturing philosophy and will have extensive trials soon.

Using their strong metallurgical knowledge, design, and engineering capability and manufacturing experience, the group has over the last few years invested heavily to create a world class manufacturing ecosystem for various products under its portfolio. From making its own ESR grade (weapon grade) steel to having full-service supply capability – right from product conceptualisation to designing to manufacturing, product testing and validation. Backed by several decades of experience in metal forming, forging, machining and metallurgy, the group has realised a major breakthrough in the small arms segment within a short frame of time with a product for DRDO.

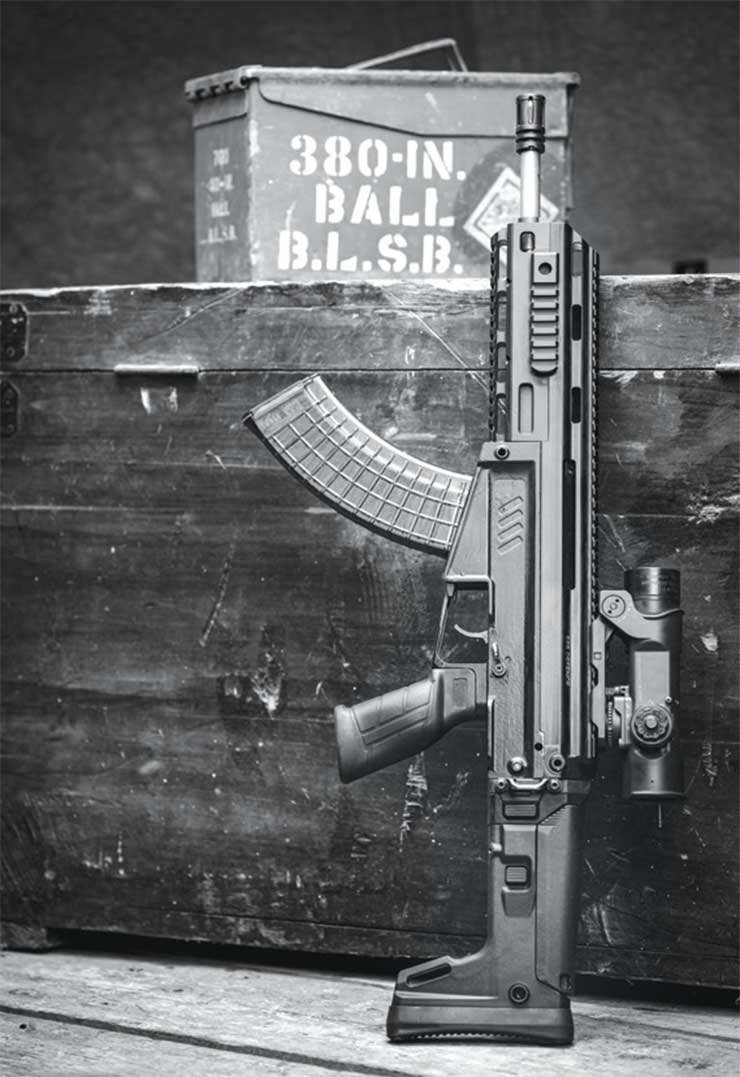

The company’s product profile includes a series of small arms – Assault Rifle 7.62 x 39mm, CQB Carbine 5.56 x 45mm, Light Machine Gun 7.62 x 51mm, Protective Carbine 5.56 x 30mm, Sniper Rifle 7.62 x 51mm and Sniper Rifle 8.6mm.

Kalyani Group is keen that the government streamlines the defence procurement process to avoid delays, promote competition and ensure efficiency. According to Bhatia, “There is an urgent need to shorten the existing acquisition cycle. This could be done by putting in place a time-bound plan for each stage of the acquisition cycle. A steering committee facilitating and monitoring the process may help ensure timely execution of the acquisition cycle.”

“The acquisition categorisation done at the time of grant of Acceptance of Necessity by the Defence Acquisition Council (DAC) should encourage categories defined in DPP 2016/ DPP 2020, in the same order of precedence, based on a detailed assessment of existing capabilities and capacities of the Indian Industry. This will also give the right impetus to Make in India.”

“Also, small arms manufacturing is a controlled sector and requires Defence Industrial License to manufacture. The process of issuing of license also needs to be a time bound function to facilitate growth of indigenous capability.”

Company: Jindal Stainless Ltd

Location: Hisar, Haryana

On January 27, 2020, Jindal Stainless (Hisar) Ltd signed a joint venture agreement with Taurus Armas SA, Brazil for transfer of technology to manufacture small arms in India. Taurus is a leading firearms manufacturer having products in service with many countries. The product range includes a wide range of small arms such as 5.56mm carbine/assault rifle, 7.62mm assault rifle, 9mm pistol for the armed forces and also Non-Prohibited Bore (NPB) small arms like the .32 revolver/ pistol for the civilian market.

In the initial phase, the company intends to manufacture NPB pistols and revolvers for the civilian market through progressive indigenisation. In respect of small arms for military use, the approach is to capitalise on the opportunities emerging through RFIs/RFPs/tender from the army and other armed forces and accordingly plan production. Proactively, it is also offering small arms to the armed forces for trial on a ‘no-cost, no-commitment’ basis.

Currently, JSHL’s main focus is to establish an ultra-modern infrastructure for manufacturing of small arms in Hisar. “At present, I may not be able to indicate the quantities which Jindal will be producing but I may confirm that we are targeting a product-mix capacity of 100,000 units per annum,” says Abhyuday Jindal, Managing Director, JSHL.

Jindal adds that Prime Minister Narendra Modi’s Make in India initiative and his subsequent call for Atmanirbhar Bharat have created huge enthusiasm in the private sector to invest in the manufacture of small arms. The liberalised FDI regime, issue of license for manufacturing of small arms to the private sector and also the ongoing/planned RFI/RFP under the Buy and Make (Indian) category of acquisition are testimony to the government’s commitment towards wider participation of the private sector to facilitate competitive procurement of modern small arms. These initiatives are aimed at extracting the best value for money against acquisition by the armed forces and to reduce dependency on import in this critical segment.

Jindal is of the view that the biggest obstacle being faced by the small arms manufacturers is abnormal delay that is taking place in regard to the procurement of small arms. This is despite industry being proactive and venturing into MoUs and joint ventures with foreign OEMs to create a robust defence infrastructure. For instance, in respect of the 5.56mm carbine, since 2011 repeated RFIs have been floated for procurement through indigenous production but not concluded to the contract stage.

Jindal is of the view that the biggest obstacle being faced by the small arms manufacturers is abnormal delay that is taking place in regard to the procurement of small arms. This is despite industry being proactive and venturing into MoUs and joint ventures with foreign OEMs to create a robust defence infrastructure. For instance, in respect of the 5.56mm carbine, since 2011 repeated RFIs have been floated for procurement through indigenous production but not concluded to the contract stage.

The government has also resorted to preferential treatment to state owned production units as in the case of the Ordnance Factory Board, Korwa, which will jointly manufacture the Kalashnikov AK-103 assault rifle. The deal locks in the long-term requirements of the armed forces. No opportunity was extended to private players for competitive bidding. “In this connection, I must mention that in order to sustain indigenous small arms manufacturing by the private sector, the standalone efforts by industry need to be supplemented by a consistent business opportunity. Also, in respect of the armed forces’ actual requirement, there is also limited flow of information to the private sector,” says Jindal.

In such an uncertain scenario, with regard to the acquisition programme and also actual technical requirement of the small arms, private industry struggles to firm-up their investment programme and take timely preparatory action to effectively respond when formal requirements emerge.

The abnormally long procurement process, particularly the time involved in finalisation of RFI/RFP, is a matter of concern and requires improvement. The licensing process also needs streamlining with the introduction of the online process for application of license, like DPIT. Private industry, being a new entrant in the sector, is not aware of various regulatory clearances and procedural requirements that are required to be met in respect of infrastructure creation and manufacture of small arms. The Ministry of Defence and Ministry of Home Affairs should provide requisite support to the private sector in this regard.

The abnormally long procurement process, particularly the time involved in finalisation of RFI/RFP, is a matter of concern and requires improvement. The licensing process also needs streamlining with the introduction of the online process for application of license, like DPIT. Private industry, being a new entrant in the sector, is not aware of various regulatory clearances and procedural requirements that are required to be met in respect of infrastructure creation and manufacture of small arms. The Ministry of Defence and Ministry of Home Affairs should provide requisite support to the private sector in this regard.

“In any theatre of war, the soldier on the ground will always have primacy and is critical to success,” says Jindal. “In this backdrop, we must acknowledge that equipping our soldiers with high quality indigenously produced small arms are highly morale boosting for the nation and a matter of pride as these are their personal weapons.”

Conclusion

Over the decades, India has spent billions of dollars on high-end weapons that have ensured it remains the pre-eminent military power in the region. Today, it is poised to become a pan-Asian power with the ability to project power into the South China Sea and up to the Horn of Africa. But while pursing regional dominance through Agni missiles, SSBN submarines and aircraft carriers, the political leadership must not forget that it is the soldier on the ground who keeps the enemy at bay. If India is going in for expensive Sukhois and Rafales, why should the Indian soldier carry the glitch prone INSAS? Shoddy rifles for the humble soldier therefore reek of elitism and discrimination. Personal weapons are just as important to the outcome of wars as the acquisition of aircraft, tanks and guns.

Also, there is the spinoff effect on the economy. With the ballpark requirement of small arms for the military and paramilitary forces at well over two million, the cake is big enough that both the state owned OFB and private players can have their shares without acrimony. And that’s not including the police forces of 30 different states that also require automatic rifles, carbines and handguns. Add in the demand for sports rifles, and we are looking at one of the largest markets for small arms in the world.

Also, depending on the environment they are used in and how well they are maintained, small arms have a life of 5,000 to 6,000 rounds. That means ongoing replacements, which should keep production lines humming for decades. The number of jobs this will create and the innovators the industry will spawn will without a doubt kickstart a new era in the Indian defence sector. Due to various reasons, for more than 70 years India missed the opportunity to create a thriving small arms industry. With a favourably disposed government in power, now is the time to make up for lost time.

– The writer is a globally cited defence analyst. His work has been published by leading think tanks, and quoted extensively in books on diplomacy, counter terrorism, warfare and economic development.